What I'm buying today - clearing out the fire sale

Taking advantage of the tariffs scares and other market mispricings

Today is Monday. Another hectic start of the week in the markets.

Markets are slowly digesting tariffs. New week, new scare - seems to be the paradigms we’re in right now.

And conventional wisdom says you should not venture to catch falling knifes in these times.

But what’s life if you don’t venture out and live a little, at least from time to time.

So I decided to take advantage of this chaos and went on a bit of a shopping spree.

And while it may not have been the best idea (time will tell …) and you probably you should not follow blindly, here are the 6 trades I’ve ventured in today

Let’s dig in:

1. Rotation into Eurozone & Chinese Equities

Thesis: Everyone and their grandmother is convinced Europe and China are done for. The common refrain? “US tariffs will crush them.” That’s precisely why I’m betting against it. These markets are the least priced for a nominal growth rebound, and with both China and the Eurozone likely to stimulate their way out of this mess, it’s a matter of catching them before the bid arrives.

Positions:

Eurozone banks (Deutsche Bank, BNP Paribas) – Direct beneficiaries of a rate-driven rebound.

Chinese industrials (CATL, BYD) – If Beijing’s stimulus hits, these run hard.

Risk: Germany’s election fails to deliver a fiscal plan or China remains hesitant on large-scale stimulus.

2. Short Overvalued US Equities / Long Inflation Hedges

Thesis: Everyone is still clinging to the "goldilocks" soft-landing fantasy. Meanwhile, inflation is sticky, and bond markets are starting to price that in. If inflation ticks above 3% again, expect rate cut hopes to get crushed, causing a repricing in the most overvalued stocks.

Shorts:

AI/software stocks flying high on cheap money dreams.

Longs:

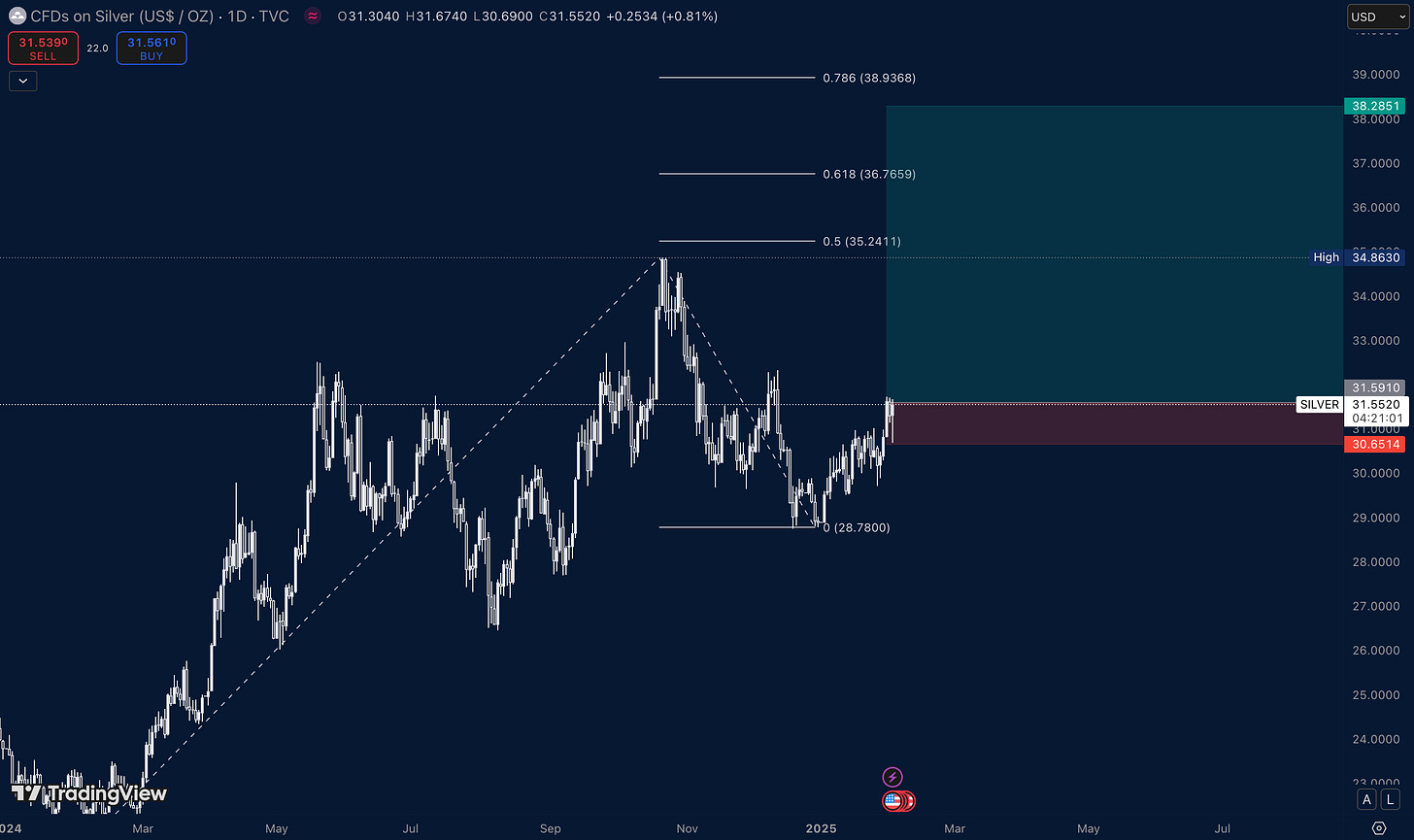

Gold, Silver, TIPS, and Energy equities (Exxon) – Hard assets win in stagflation.

Risk: Core PCE drops below 2.3%, forcing the Fed to accelerate rate cuts.

Although, as an addendum, I’ve actually added a little bit more to my NVDA 0.00%↑ position today, I’ve also bet slightly against this being the bottom for US AI overvaluations.

Look for my commentary on Gold and Silver in the next sections. Heavy bets there.

If you’d like to see more in-depth analysis like this , find out what trades I take to outperform the markets and build an alpha-driven portfolio, then you need to upgrade today!

Only for a limited time, my annual plan is -40% OFF

When you subscribe, you take the guesswork out of investing and trading, and focus on nuanced insights derived from the latest macro alpha that take you beyond an ordinary grasp on the markets

3. Long ASX Fund Managers & Investment Platforms

Thesis: In the contrarian trades department, this one is overlooked. Australian asset managers are printing performance fees, and retail inflows are surging while the world focuses elsewhere. Most of these stocks still trade at a discount to global peers despite massive 2024 rallies.

Positions:

Pinnacle, Hub24, Netwealth – Beneficiaries of earnings beats and rate cuts.

Catalysts:

February earnings season (Pinnacle Feb 5, Netwealth Feb 12).

Risk: Market volatility reducing inflows or fee compression from competition.

4. Long Small-Cap US Stocks

Thesis: Tariffs hurt multinational giants. But what about the smaller, domestically focused businesses that don’t rely on overseas supply chains? These companies have been left for dead, trailing large-caps by 15% YTD. That’s a setup for outperformance if “reshoring” policies take hold.

Positions:

Industrial suppliers with <$2B market cap.

Regional banks (KeyCorp) benefiting from rate cut sensitivity.

Risk: A broader economic slowdown negating the tariff advantage.

I’m speculating here on capital flowing out of the mega-winners (like the Mag7) and into the underperforming underdogs. Seeing a very real possibility of this in Q1 2025.

5. Long German Bunds / Short Peripheral EU Debt

Thesis: While the consensus screams “stay away from Europe,” I see an asymmetric bet. The ECB’s rate cuts could stabilize Germany while weaker European economies remain vulnerable. This trade plays the divergence: Germany rebounds, Italy and Spain struggle. (along with Portugal and Greece as well)

Target Spread: German 10Y yield tightening to 1.8% vs. Italy’s 4.5%.

Risk: An EU debt crisis reigniting due to unexpected tariff spillovers.

And finally … the big one

6. Long Gold & Silver – The Physical Metal Squeeze Is Here

Thesis: Here’s where Perplexity got it wrong. There’s no reason to be shorting precious metals when we are seeing a massive supply squeeze play out in real time. Physical gold and silver are moving out of London at an unprecedented rate. JPMorgan is scrambling to deliver against futures contracts. And when banks start begging central banks to lend them gold, you know something is broken.

Positions:

Physical Gold & Silver (no paper derivatives, I want real metal).

Catalysts:

COMEX futures are trading above London spot prices, signaling an arbitrage opportunity.

London vaults are getting drained – central banks are getting requests to loan their gold holdings.

Risk: A sudden collapse in inflation expectations or central banks dumping reserves (unlikely given geopolitical risks).

I expect both Gold and Silver to continue to rally. Gold seems overdue for a correction, in that case the level should be a good buying opportunity. Silver is in the process to starting a fresh new rally. (driven also by industrial demand !)

Final Thoughts

Markets are full of mispricings, but few are willing to lean into them when the headlines scream panic. Tariff fears, inflation bets, and the precious metals squeeze are all unfolding at the same time. That’s the backdrop I love trading against.

These six trades might not be popular right now, but that’s exactly why they have the highest potential upside. Time will tell how they play out, but if the market overreacts, there’s nothing wrong with catching a falling knife – as long as you know how to sharpen it.

Stay tuned.

Let’s see how this plays out.

Michael