Weekly Macro Alpha Report (Oct 1st - Oct 8th, 2024)

Introduction:

Welcome to the Goldilocks regime. If you’re paying attention, you know what that means: falling inflation, steady growth, and a market that’s rallying across the board. But the smart money knows this is a window, not a permanent state of bliss.

Inflation is dropping, stocks and bonds are moving up together, and capital is shifting along the risk curve—from bonds, to equities, to the outer edge of risky assets like Bitcoin. Your job? Maximize profits while keeping an eye on the exit.

This is not the time to sleep on strategy. It’s the time to get precise, get aggressive, and get your ducks in a row before the regime flips.

Let’s break down the week and carve out where you can position yourself to dominate the market in the days ahead.

1. Macroeconomic Developments

U.S. Economy – Riding the Goldilocks Wave:

The U.S. economy is growing fast—3.0% in Q2 2024 is solid, almost twice the rate from Q1. Employment is stable at 4.2%, but don’t let that give you comfort.

Consumer confidence is plummeting (from 105.6 to 98.7), and that’s the real canary in the coal mine. Confidence dips mean consumer spending, the backbone of GDP growth, could falter in the months ahead. But for now, the Goldilocks zone is intact.

Inflation’s coming down (2.7% year-ahead expectations), and we’re seeing rate cuts on the horizon. That’s fuel for continued market upside—for now.

Global Outlook – The World’s Not as Rosy:

Europe’s flirting with stagnation. GDP growth was revised down to a paltry 0.2%, and inflation is cooling fast, which means the ECB might have to keep slashing rates just to keep the economy breathing.

Japan? A mixed bag. Consumer confidence is up a bit, but real wages are down, and household spending fell by 1.9%.

China, meanwhile, is throwing $28 billion at local governments in stimulus to shore up weak growth, but the big picture there is one of structural weakness, not long-term strength.

Macro Analysis:

In the U.S., it’s a race against time—before consumer confidence really dents spending, you’ve got a window to ride the market higher. We’re in a perfect environment for stocks and bonds to keep moving up together.

But outside the U.S., things look murkier.Europe’s struggling, Japan’s fighting stagnation, and China’s throwing band-aids on bigger issues.

This divergence between U.S. strength and global weakness is important. The U.S. markets are the clear outperformers, and your strategy should reflect that.

Strategic Takeaway:

U.S. Equities Over Global: Stay overweight U.S. stocks. The domestic market is insulated (for now) from the global drag, so this is where you want your money.

Watch Consumer Data: Pay attention to retail sales and consumer sentiment updates. If confidence keeps dropping, expect future earnings reports from consumer discretionary sectors to take a hit.

Global Exposure? Trim It: Europe and Japan offer little in the way of upside. The global slowdown could hurt multinationals. Keep your international exposure to a minimum.

Bonds Still Matter: Bonds are your short-term safety net. As inflation drops and rates head lower, bond prices will rise. Build exposure here as a buffer.

Rise in DXY: The recent rise in DXY is not only due to rising geopol tensions & uncertainty, but it is also due to the fact the US outperform the rest of the global economy. Globally, much to the chagrin of BRICS, peeps are still buying US. And rationally, objectively, you can't blame them.

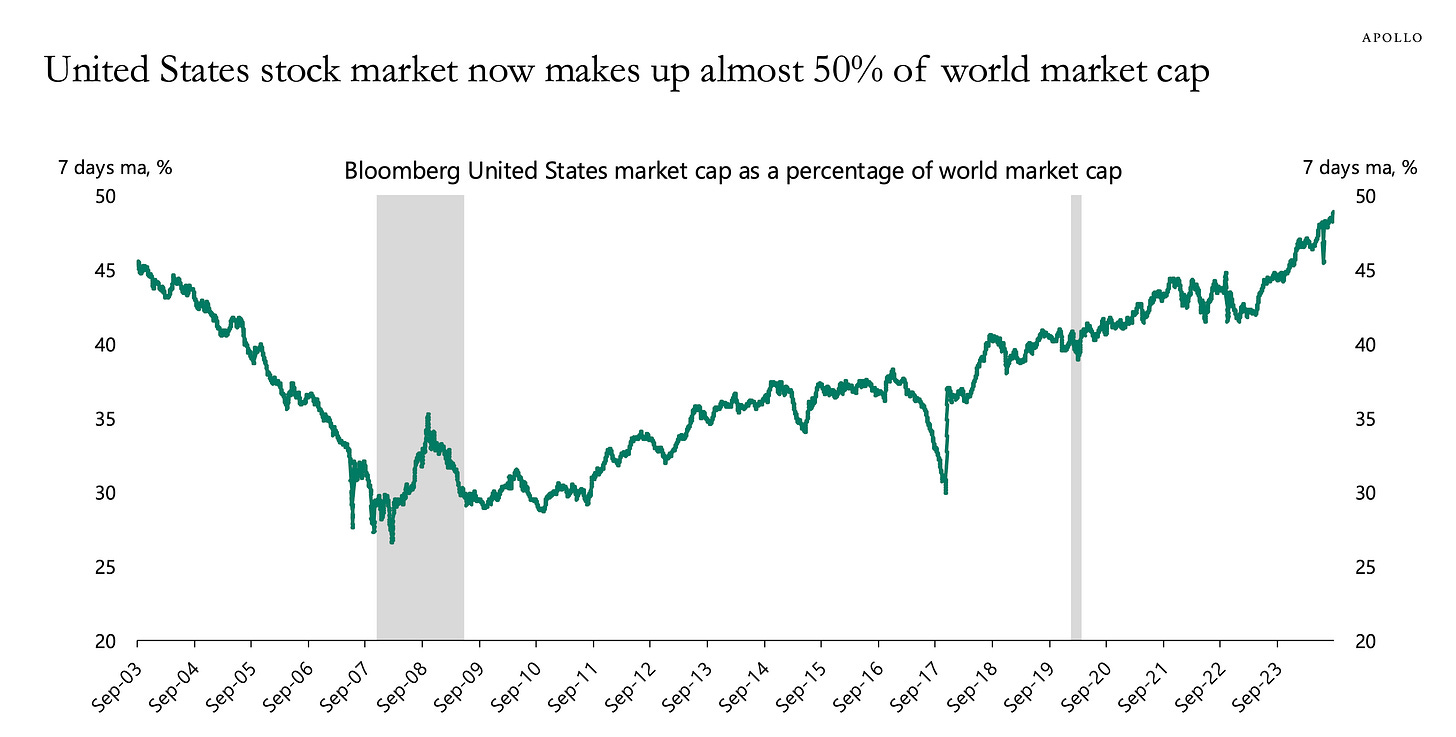

Take a look at this nugget (honestly you don't want to miss this!):

As of October 2024, the United States commands an astonishing 50% of the total global equity market, solidifying its status as the unrivaled powerhouse in the world economy and reshaping investment strategies across the globe.

An image is worth 1000 words… Well take a look at the chart above. We've gone from 30% of global MCap to over 50% of global MCap as of Oct 8th, 2024.

The US remains THE best place to park your capital. And THE place where you have both:

easiest access to capital

access to the largest amount of capital

All in all - good for business.

As long as the current Goldilocks regime continues, bet heavy on the US.

2. Financial Market Developments

Bond Yields – The Heartbeat of the Market:

Yields are rising in the short term. The 10-year Treasury yield is up to 4.03%, but don’t let that fool you. The broader macro trend is pointing toward lower yields as rate cuts begin to roll out. This is temporary. In a Goldilocks regime, rates fall, bonds rally, and equities follow.

That means you should expect bonds to keep moving higher as inflation drops and central banks ease monetary policy further.

S&P 500 & Nasdaq – A Short-Term Dip in a Long-Term Rally:

The S&P 500 dropped 1% and the Nasdaq 1.2% in the last few days.

Mild correction from ATH.

Tech stocks are getting hit harder due to rising yields, but this is all noise. In the Goldilocks environment, where inflation falls and rate cuts come into play, capital rotates into equities, especially growth sectors.

This week’s dip is an opportunity to buy the future winners. But be selective.

You don’t want to catch a falling knife—focus on high-quality tech and AI plays that can weather yield pressures.

Bitcoin – The Final Frontier of Risk:

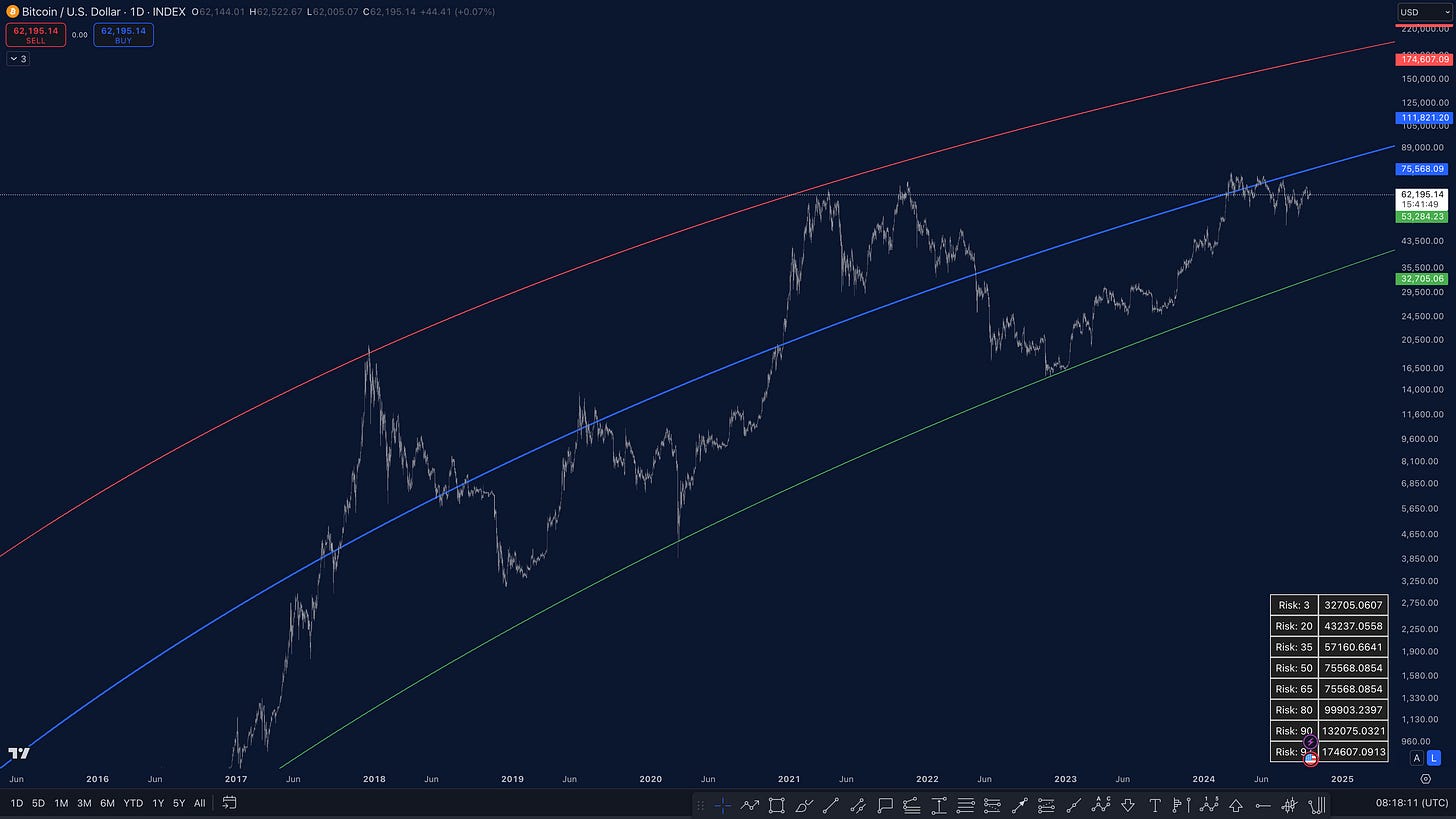

Here’s where things get really interesting. Bitcoin is sitting comfortably above its 200-day moving average, and the technicals suggest that we’re nearing the end of its corrective phase.

Bitcoin thrives at the edge of the risk curve, and in this Goldilocks environment, as stocks and bonds rally, capital inevitably moves to the riskiest assets last.

When money flows from bonds to stocks, the next stop is Bitcoin. The bullish scenario is setting up.

According to our proprietary model, Bitcoin is now below it's long-term fair value. Which means on a scale of 1 to 100%, risk of buying some spot BTC is now less than 50%. Depending on your risk tolerance, appetite, 60k and immediately below, might be good spots to accumulate some more. Here's a chart of this data:

Financial Markets Analysis:

Rising bond yields may spook the market, but in the context of Goldilocks, they’re a buying signal, not a selling one. This week’s dip in equities is noise, and the bigger picture is one of rising stock and bond prices together. Meanwhile, Bitcoin is on deck for a breakout as capital seeks higher-risk opportunities once stocks get saturated.

We're probably gonna see a bit more chop around markets, till they decide to resume further growth. I am over 90% sure WallStreet wants to take SPX to $6,000 and above!

Strategic Takeaway:

Bonds First, Then Stocks, Then edgier stuff: With yields elevated, bonds are your first play. But once they start to come down (and they will), equities will catch the bid. Timing is key here—build your bond position now, and also DCA into stocks and into edgier stuff. More % of your portfolio into stocks. Less % into edgier stuff (like BTC).

Buy Quality Dips: Focus on high-quality growth stocks. Tech might be vulnerable to rising yields in the short term, but long-term, it’s where the real money will be made as rate cuts feed into growth expectations. I also expect financials to start performing really well, really soon.

Bitcoin Is Warming Up: Bitcoin thrives when the risk curve shifts. Keep an eye on key technical levels like $57 - 60K. Good areas for buying spot. When it breaks through $67-68,000 , that might signal we're now pumping to a new ATH.

(last ATH was March 14, 2024 at ~$73,700 )

If you like valuable strategic macro alpha like this report - you gotta subscribe to The Macro Edge. Inside you get goodies like these report every single week, along with actual trade updates - when we open positions, when we close positions, open-trades updates - along with access to

Our portfolio

Unique models that are not available anywhere else

High-end, deep education

Latest alpha unavailable in general sources/channels

Projections, future trends

Access to the exact trades we've got going on- we've been driving CAGR 27,56% over the last 10 years.

3. Socio-Economic and Geopolitical Events

Middle East Tensions – Volatility in Oil Markets:

Iran’s missile strikes on Israel and the subsequent Israeli ground operations in Lebanon have rattled the energy market, pushing oil prices up by 3% to $77 per barrel. Geopolitical risk is back on the radar. While it’s tempting to worry about how this might derail broader market rallies, keep in mind: a Goldilocks regime can absorb oil shocks as long as inflation remains under control.

The energy sector is benefiting from the chaos, and that’s where short-term money could flow.

Russia-Ukraine War – Status Quo, but Watch for Disruptions:

Russia’s ongoing operations in Ukraine haven’t significantly shifted market sentiment yet, but that doesn’t mean you can ignore it. The war could still create unexpected supply shocks, especially in energy markets. Keep this in your peripheral vision.

Geopolitical Analysis:

Geopolitical events are a volatility driver, but in a Goldilocks regime, as long as inflation stays in check, they don’t derail the broader market. The energy sector is benefiting from the oil price spike, and that’s your immediate play. Just don’t get too comfortable in commodities—once tensions ease, prices will come back down fast.

Strategic Takeaway:

Play the Energy Spike: Take advantage of the short-term boost in oil prices. Energy stocks like Chevron and ExxonMobil will continue to rally as tensions escalate. Just be ready to cash out when the conflict cools.

Commodities Hedge: If tensions flare up even more, gold and silver offer a secondary hedge. But don’t overload—this is a temporary play.

Don’t Overreact to War: The Russia-Ukraine conflict is background noise right now. Unless it starts impacting key supply chains, it’s not a reason to panic in the broader market.

4. Impact on Markets

S&P 500 – Still Bullish:

Despite the 1% drop this week, the S&P 500 is still in an uptrend. This is just a pullback within a larger rally. As yields fall and the rate cuts take hold, equities will catch the bid again. Don’t let short-term noise shake you out of your positions—this is still a market you want to be in.

Nasdaq – Buy the Dips in Quality Tech:

The Nasdaq’s 1.2% drop is more about rising bond yields than anything fundamentally wrong with tech. In a Goldilocks environment, tech and growth stocks benefit disproportionately as inflation falls and rate cuts filter through. Look for opportunities in AI-driven sectors and key tech players.

Bitcoin – Breakout Potential Looming:

Bitcoin is the real wild card here. It’s sitting at the edge of the risk curve, and in a Goldilocks environment, capital flows to risk assets last. Once the rally in equities is strong enough, the next move will be into Bitcoin. The technical setup looks strong—this is a market waiting to explode upward once the right catalysts hit.

Market Analysis:

In a Goldilocks regime, everything rallies, but it happens in stages. Bonds first, then stocks, and finally, risky assets like Bitcoin. The S&P 500 and Nasdaq are still primed for upside, but the big money will flow into Bitcoin when equities get crowded.

Strategic Takeaway:

Stay Long on the S&P 500: This pullback is temporary. As yields drop, expect equities to rally hard.

Nasdaq – Quality Tech First: Focus on companies with strong balance sheets and AI-driven growth prospects. These will be the first to benefit from rate cuts.

Bitcoin – Ready for Liftoff: Once Bitcoin clears resistance, it’s time to get aggressive. Keep an eye on key levels like $28K. This is your big move if the rally broadens.

5. Sources of Alpha

Energy Stocks: Oil is spiking, and the energy sector is booming. Ride the wave with big players like Chevron, but be ready to exit fast when tensions cool.

Bitcoin: With the technicals pointing to a breakout, Bitcoin is where the most upside lies if you're willing to take on more risk. Look for a clean break above $28K.

Tech and AI: Microsoft’s earnings and other AI-heavy companies will get a short-term bump, especially once yields start falling.

Commodities Hedge: Play gold and silver as a hedge, but keep exposure limited. They won’t run like Bitcoin, but they provide a nice balance if geopolitical risks flare.

If you like valuable strategic macro alpha like this report - you gotta subscribe to The Macro Edge. Inside you get goodies like these report every single week, along with actual trade updates - when we open positions, when we close positions, open-trades updates - along with access to

Our portfolio

Unique models that are not available anywhere else

High-end, deep education

Latest alpha unavailable in general sources/channels

Projections, future trends

Access to the exact trades we've got going on- we've been driving CAGR 27,56% over the last 10 years.

Subscribe to a paid plan TODAY and access everything above & more

6. Actionable Insights

Bonds First, Then Equities: Ride bonds for now, but be ready to rotate into equities once yields start to drop. Don’t get stuck on the sidelines.

Focus on Quality Growth: High-quality tech, AI, and healthcare should be your targets. Ignore speculative plays that can’t survive yield pressure.

Bitcoin on the Verge: Watch Bitcoin closely. If it breaks through key resistance levels, go long and take advantage of the high-risk environment.

Keep a Quick Exit on Oil: Oil prices are volatile, and while energy stocks are winners for now, don’t be greedy. Exit before geopolitical tensions resolve.

Conclusion:

We’re deep in a Goldilocks regime, and this is where smart money gets paid. Inflation is cooling, growth is steady, and the Fed is primed to keep cutting rates. Your playbook? Bonds first, then equities, then Bitcoin. Ride the risk curve strategically—don’t get overextended, and know when to cash out. This regime won’t last forever, but for now, it’s time to capitalize.